Did you ever keep a money jar growing up or a savings jar where you stored all of your loose change? I did. I searched for pennies in stores and saved up the nickels and dimes from my weekly chores. When I got home, I raced to my room to hear the coins plink against the glass.

A container full of pennies didn’t make me rich or lead me to financial independence, but it did teach me invaluable financial lessons. By saving money in a jar, I developed money-management techniques that lasted throughout adulthood.

When my kids were barely old enough to count, I introduced them to economic concepts. In the beginning, we focused on the value of coins and played never-ending grocery games complete with cash registers and child-sized ATMs. Then we added the concept of a kids’ piggy bank.

We stored glass savings jars on their dressers, just like I did as a kid. Does saving money in a jar plant the seeds for financial success? Without a doubt, it can.

Piggy banks are a great money saving technique, because saving change is easy. You don’t need immense amounts of discipline or a high salary. Just empty your pockets, put money into a jar and watch it grow.

The amount of money you save isn’t important in the beginning. Generating piles of loose change is much more manageable than gathering big bills. The goal is less about how much money you save and more about establishing money-saving routines.

Some may argue that money saving jars won’t lead to significant wealth, but starting small is the best approach to money management. It makes it easier to see your progress and achieve your goals.

If you want to create new habits, nurture your money mindset, and sharpen your money management skills it’s time to grab a glass jar and begin. You’ll find a bunch of fun, money jar ideas below to get you started.

Lessons Learned From Saving Money in a Jar

How do money jars lead to financial success? Let’s imagine you carry cash wherever you go. When you go to the store, your money is accessible. If you want to buy something, you reach into your pocket to pay for it. Unfortunately, this can lead to needless spending.

When buying new stuff is too easy, we can spend money without making a plan for it. It leads us to live on autopilot rather than asking ourselves what we want out of life. While this seems okay as we stand at the register, it prevents us from achieving wealth or creating a plan for our lives.

How can we prevent needless buying? We can make it harder to spend. Instead of keeping cash in our wallets, we can store loose change in money jars.

When saving money in a jar, it doesn’t matter how much you set aside. Maybe you pull out coins or every $5 bill you find. Either way, you won’t have as much money available when you return to the store the next time.

Each time you put money jar, take a brief moment to think about saving. With every deposit, you are making a conscious decision not to spend.

On average, it takes 66 days for an action to become a habit. So try not to quit using your money jar before that time. Keep dropping those coins day after day without stopping for as long as you can.

Keep in mind; money jars won’t deprive you of the things you desire. We’ll use them to achieve bigger, long-term financial goals.

Using Money Jars to Set Savings Goals

Money jars help you visualize your future. When you figure out what you want out of life, you can design a course to get there. So, before you make a money jar, you need to declare financial goals.

A key to money management is assigning every dollar you earn a job. If you don’t know what you want to do with your income, it’s easy to blow it on stuff you don’t need.

How can saving money in a jar help you meet your financial goals? First, figure out why you need money. What will you do with the money you save? After paying for our basic needs, we don’t need much money to live a good life.

So, before saving money in a jar, ask yourself why you are saving. What do you want your money to do for you? Do you want to build an emergency fund, take a family vacation, or save for classes that can provide exciting new skills?

After you pay your bills, why do you work? What do you love to do? What passions do you want to pursue?

Which goals do you want to accomplish over the next few weeks, months, or years? Which of these goals are the most pressing, important, or make your heart sing?

If you have a partner, host a family financial meeting and discuss your objectives with them. Use your conversations to define your life plan.

What is your wildest dream? Write it down and create a money jar to track it. Your financial goals help you figure out what to do next. What is the purpose of the money you save?

Research Your Financial Goal Before Making a Money Jar

Once you set your goal, you’ll need to figure out how much it costs to achieve it. Researching specific numbers will help you figure out just how much you need to save. Once you reach that number you can tap your fun money.

Now is the time to investigate your options.

If you want to travel to Hawaii, figure out how much a plane ticket costs, how much you’ll pay in housing during your visit, and what food might cost for the week while you’re away.

If you want to take an art class, look at the prices online and determine how much supplies cost.

Money Jar Ideas #1: How to Make a Money Jar

Getting started is easy. Before making a money jar:

- Think about the size of your container.

- Find a container that is big enough to support the amount of money you need to save. If you have a small goal, you can scrounge up a tiny jar.

- If you have a big objective, search for a larger container.

Remember any old jar will work. My oldest son uses a mason jar as his coin bank. My youngest son prefers a smaller glass container.

Choose an achievable goal. Most of us can’t save tens of thousands of dollars using the money in our jars. So start with small goals you can accomplish. We’ll get to more significant aspirations later. You can’t set a goal of early retirement with a tiny bowl of change.

Next, label your goal and your jar. Label it honeymoon fund, vacation fund, adventure fund, concert, education, trip to Tahiti, new guitar, or anything else you desire.

It doesn’t matter what you write on that jar. Just give it a name. Grab a sharpie, a sticker, or a piece of paper and some old-fashioned tape. Then say your goal out loud and visualize yourself achieving it.

If you dream of Tahiti, picture yourself sitting on the beach. If you want a new guitar, imagine yourself singing by a campfire.

Money Jar Ideas #2: Add a Photo to Your Money Jar

There are lots of money jar ideas and challenges to help you save, but creating a motivating savings jar is the most important step in the process. After placing a label on your savings jar, print a picture that captures your newfound goal. You can choose an image from the internet or a photograph from a recent experience. For example, if you dream of a beach vacation, search for a picture from your last trip to the ocean. The idea is to create a money jar that symbolizes your goals and dreams.

If you want to create multiple savings jars, that’s okay too. Use bigger jars for your larger goals and smaller ones for goals that won’t cost as much money.

Money Jar Ideas #3: Place Your Jar in a Visible Location

Place your savings jars in a visible location. Use a room that you frequent often. In your house, that might be your living room next to the television or on a table right beside the front door. Wherever you place it, make sure that you walk by this particular location often.

Money Jar Ideas #4: Keep a Running Tally

Some people like to keep a running total on their savings jars. Others wait to count until the container is full. Keeping a tally helps you figure out how far you have left to go. If you choose this option, write the running total on a piece of paper attached to your jar.

Money Jar Ideas #5: Visualize Your Financial Goals

Each time you drop money into your savings jar, think for a few seconds about the goal you set for yourself. Assign your cash to accomplish your goal, and you’ll feel less tempted to spend it on something else.

You can select a vacation savings goal and use your jar as a travel fund or a home improvement goal to repaint the house. If you feel particularly strapped for cash, use a savings jar to create an emergency fund.

If you feel tempted to use your money for another purpose, take a hard look at the picture taped to the front of your savings jar. Imagine yourself in the future. Do you need to spend on something else, or will you feel disappointed many months from now?

Money jars help us visualize financial growth. When we see that pile of coins building, we begin to see progress, and seeing is believing.

After a while, a pattern emerges from this simple act of dropping money into a jar. Rather than keeping cash on hand to spend, you’ll give it a task. You’ll roll your pennies and wait for another day to use them.

Money Jar Ideas #6: Virtual Savings Jars

In the world of digital currencies, it’s not always practical to save money in jars. If you don’t carry cash, you’ll need to get more creative.

Separate online bank accounts can work like money jars in the digital space. Rather than dropping spare change into your glass jar, you’ll move money from your checking account to a savings account used for specific goals. You can think of a bank savings account as a virtual piggy bank, and it works just as well as a real one.

You can move significant dollar amounts or save the change. For example, if you have $90.25 in one account, you can slide 25 cents into savings. It won’t feel like much, but again, the goal is not to save a million dollars through this technique. It’s to create a mindset for saving.

Money Jar Ideas #7: Cute Money Jar Ideas

If you don’t keep spare change on hand, you can fill your money jar with marbles. They can help you visualize progress the same way that coins do.

Drop marbles into your savings jar when you move money from your checking account to your savings account. Decide how much money each marble represents and drop that number into the jar.

Find a jar that is big enough to hold your financial goal. If you need $500, each marble can equal $10. When you fill your container with 50 marbles, you’ve met your goal.

You can fill your container with anything that will help you visualize your progress. If you want to use gum-balls, cotton balls, thumbtacks, or Hershey kisses, those will work too.

Write down the total on the outside of your jar. Keep tabs on the amount you’ve saved and how much longer you have to go.

Why can’t you use a bank account and a spreadsheet? Why do you need a money jar? Well, of course, you don’t need a money jar, but sometimes using visuals is more motivating and fun.

Money jars are a fun way to trick you into saving, and the more you enjoy saving, the easier it will become.

Money Jar Ideas #8: $5 Savings Jar Challenge

Decide on the best way to save. Some people love a money challenge. Others prefer to dump their excess coins into the money jar at the end of the day. If you have an extra dollar in your pocket add that too.

If you like a challenge, try the $5 savings jar money challenge. Place $5 bills in a savings jar each time you find one in your wallet.

If $5 seems too small, aim for $10 or $20; if it feels too large, aim for $1 bills. It depends on how comfortable you are removing those bills while still meeting your other financial obligations. You can choose any set amount of money to save each week.

Ask yourself what you can cut back on to fill that jar? What items can you cut from your budget? Are there items you won’t miss once you stop paying for them?

Money Jar Ideas #9: 52 Week Savings Jar Challenge

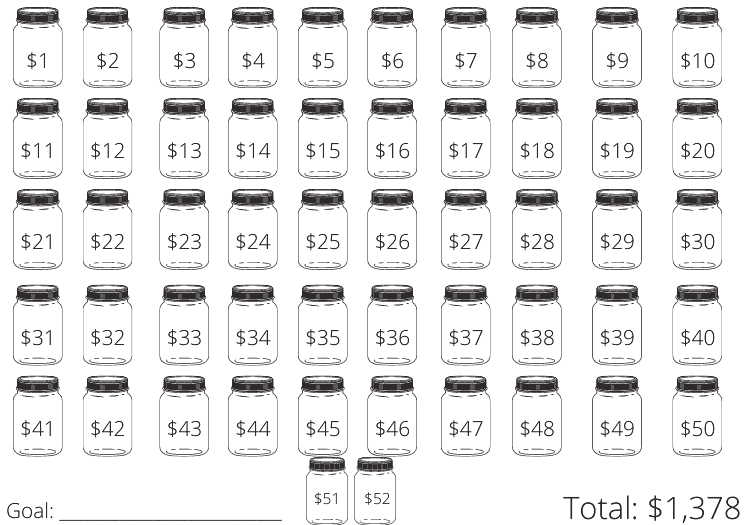

The 52-week savings jar challenge is another fun way to save money. For the first week, you save $1. The following week you save $2. You’ll continue this trend until you reach week 52.

You don’t have to follow the amounts in order. If eBay sales leave you with extra money one week, go ahead and save it. Putting money aside takes the pressure of another week when you might have less to spare.

It might not be difficult to save $1 or $2, but you’ll need to save $49, $50, $51, and $52 before the money challenge ends. At the end of the 52 weeks savings challenge, you’ll save $1,378. Drop that money each week and watch your savings grow!

Free 52 Week Savings Jar Printable Tracker

You can download a free 52 week savings challenge printable here and tape it to the side of your container. Simply color in the corresponding jar each time you save.

Savings Jar Ideas

Savings jars help you create a long-term plan for your money, but that doesn’t mean you can’t have fun with them too. You can also use savings jars as a means to splurge.

If you don’t have a specific goal in mind, write FUN on the side of your jar. Then use the money inside to meet up with friends, take a class on a whim, or go to a concert when tickets become available.

You don’t have to earmark all of your money for specific items or events. It’s okay to have pure fun with it. You aren’t any less intentional with your money if you choose to spend it this way.

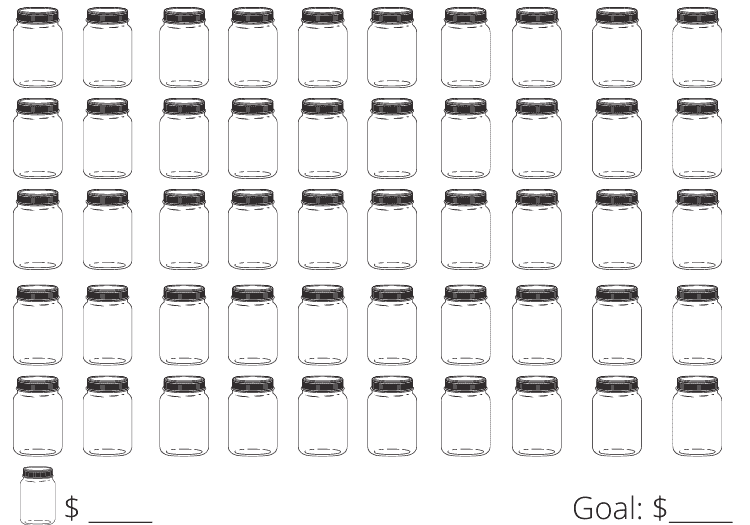

Free Printable Savings Jar Tracker

To get started, I’ve included a free mason jar savings tracker. Just click here to download the free printable and tape it to the side of your container. You can write the amounts as you save them or assign each jar a specific amount of money. For example, if you are playing the $5 challenge, each empty container can represent $5. When you save money, grab a marker and color in one jar. The mason jar savings challenge is a fun way to watch your savings grow.

Final Thoughts

If you are new to creating money jars, start with small amounts. In the beginning, you may need to focus on frugal living, but as your savings builds, hone in on the goal of earning more.

Each time you save money in a jar, commend yourself on protecting and caring for your future self. Keep depositing your coins and build off the excitement and momentum you feel.

Use that energy to learn about growing your income and investing the money you save.

How do you deposit or “cash in” your coins when your challenge is completed? Do you roll them?

i roll up all my change take it to the bank