Each month my husband dutifully records each and every financial transaction in GnuCash. He reconciles the checkbook and then documents the credits and debits associated with our four credit cards.

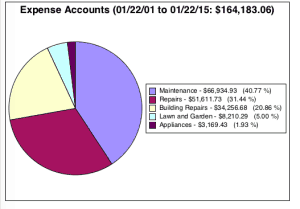

Every so often I run income and expense reports to provide a snapshot of where our money is going. I usually do this on a monthly or yearly basis, but yesterday I decided to run an expense report detailing costs for repairs and maintenance over the past fourteen years.

The total stands at a whopping $164,000!

After many years of focusing solely on long term plans for early retirement and purchasing a vacation home, my husband and I began hiring contractors to fix up our primary home. We started by replacing the windows, painting the house, installing a generator and remodeling our bathrooms.

This year we agreed to remodel our basement, which started out with a modest $20,000 estimate but will most likely cost $35,000 to $40,000 when all is said and done.

I must admit that I have changed my tune quite a bit from the early days of home ownership. There was a time when I was willing to live with windows that didn’t open, paint that was cracking and 1950s bathrooms.

My change of heart is a direct reflection of the change in our financial situation. As our retirement accounts continue to grow and the mortgages on our two homes shrink I no longer wish to delay gratification.

I no longer want to avoid the eye-sore we call a basement or force myself to use air conditioning because the screens in my windows can’t hold back the bugs.

While it is painful to part with such large sums of money it feels good to look around my home and see how much more comfortable, cozier and cleaner and it now feels.

For the record not all of the money was spent on upgrading our home. A good chunk of the cost involves big ticket items like replacing air conditioners and other household appliances. Certain things needed to be done whether we liked doling out the money to do them or not.

I also believe there is a good deal of bleed over of expenses from our beach house. I have a feeling a number of expenses were incorrectly categorized. In North Carolina a lot of the contractors require cash payments and those ATM withdrawals most likely showed up in the books from our primary house rather than our rental home.

Still $164,000 is a whole lot more than I would have guessed we spent over the last fourteen years. I would’ve ball parked that number about half that amount!

That’s like a whole new house in a lot of places!

We’re at the delayed gratification stage now. We bought this house a couple years ago and every wall is peach still. We are updating a powder room, but it’s been months since we ripped it apart and it’s not all back together yet (we’re lazy)

I understand why you would want a house that doesn’t annoy you. One of the regret my mom has is not buying the type of house she wanted sooner.

The main thing that caught my eye though was GNUCash!? We just started using it and I thought we were the only ones!

We’ve been using gnucash for ever. It’s not perfect, but my husband seems to like it better than most of the budgeting software out there. It generates a lot of great reports and seems to handle a lot of data, ours dates back to 2001.

It’s tough to figure out when to pull the trigger on home remodeling or any big purchase for that matter. We were in deprivation mode for so long that it feels good to open the wallets a little to make things more comfy and enjoyable.

I’d like to hear more about GnuCash sometime if you think it’s a good efficient system.

That is a LOT of money but I suspect you’re happier with the end result than you might have been if you’d paid more in the first place for a nearly new house with all the updates the seller thought were necessary at the time. And who knows, you may not have liked everything about that more expensive house and still wanted to make some changes!

That’s an interesting perspective. We purchased our house in 2001 years before the market reached record highs. We’ve done a lot to the house, but given the fact that we purchased it at such a good price it probably doesn’t hurt that we’ve put so much into it. Had we bought it when the market was high it might be a totally different story!

There are still things I don’t love, but that’s probably the case in every home. Our house was built in the 1950s so it has a ‘closed off’ feel. We opened the basement into one big room and one day I’d like to see us knock out a few more walls to open up the dining room and kitchen.